We are very concerned about your investment. We are always thinking that your hard earned money is very valuable to you and you are vary important for us. We are managing your money with RISK AVERSE approach. For that we are following Rule

“Rule No. 1 : Never lose money.

Rule No. 2 : Never forget Rule No. 1.”

―

BLTP Strategy is simple and it works on set of rules stated by world's Renown Investors

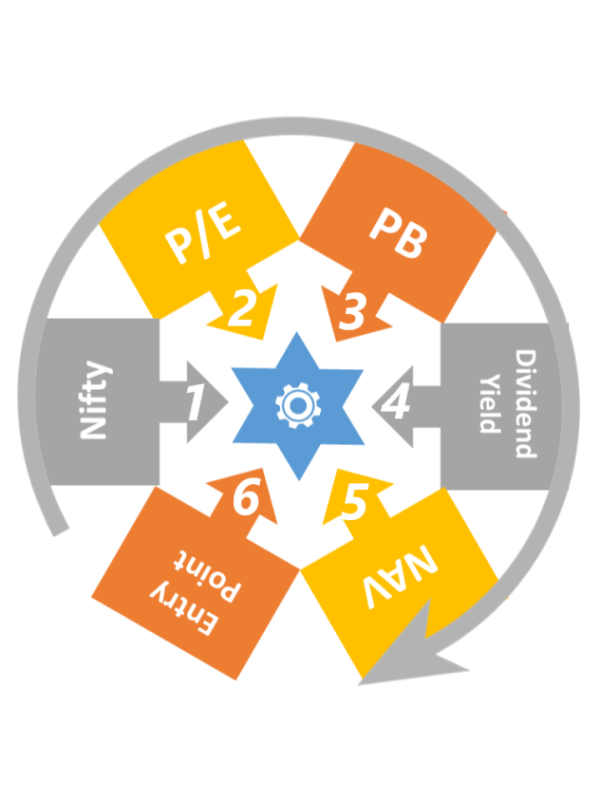

While studying we found that the behaviour of the investor is totally opposite of what it should be. We have design this mechanism with keeping above rules in the core of the mechanism. We are following 6 parameters Nifty, Nifty-PE, Nifty-PB, Nifty-Div Yield, NAV of the MF Scheme and last and most important is starting point of your investment. By using above parameters we are deriving a risk factor every month and after comparing that risk factor we are deriving the amount to be invested in equity scheme.

BLTP is tested during Designing period from 2008 to 2018 with so many different combinations of schemes and now a days BLTP is used by more than 440+ users and Managing more than ₹1250+Crs across the industries and growing faster.

“Focus on Margin Of Safety Returns will

be earned as By-Product”

―

“Margin of Safety is always dependant

on the price paid”

―

Benjamin Graham

“Returns are nothing but reflections

of Investor behaviour towards the Market”

―

BLTP is most suitable mechanism for those who wants to achieve their Financial Goals with higher safety

BLTP - Magic Pension without Tension is the most safest and better option for getting Incremental Monthly Income

BLTP - OTMS is the only mechanism for Management of Housing Society's One Time Maintenance Fund.

BLTP - DAAP is the advanced Dynamic Asset Allocation Plan with BLTP features. Investors who's horizon is less than 7 years and having moderate / conservative profile.

BLTP - FAAP is designed to attract FD Investors who are not comfortable with market volatility and doesn't want to take market risk and also not having 7+ years horizon.

BLTP - DAAP - SIP is the perfect method of doing SIP. Where you will be managing risk involved every month while building your portfolio. You may call it SIP with Risk Management

1st Generation of an Investment - As in earlier days we use to invest lump sum money in Mutual Funds at the time when the market is lower [as per our assumption] and redeem it at certain level of the market, all the decisions were taken by us on predictions of the market scenarios but it might be wrong or right and also influenced by FEAR & GREED factor, as a result of this we could not get the benefit from the market properly. All this forced Investor to think about “2nd Generation of an Investment”.

2nd Generation of an Investment After learning from the past a new generation Investment Mechanism is born called SIP/STP. In this mechanism we could managed market movement better than 1st Generation of an Investment Mechanism because in this Mechanism we invest same amount regularly which leads us to getting the rupee cost averaging. Last few years market scenarios taught us so many things one of them is that SIP/STP also failed to get better returns. All this forced Investor to think about “3nd Generation of an Investment”.

3rd Generation of an Investment –As a result of above requirement we have developed a new generation of an Investment mechanism called BLTP. In BLTP we have removed all the loopholes from SIP/STP, which were the main cause of the lower returns. In BLTP we have removed unnecessary buying at higher risk level and pumped more money at lower risk level of the market for this we have developed some formulae to decide which level is higher or lower. On basis of this we decide how much is to be invested.

1] You have to select 2 different schemes of the same fund house one is Debt scheme in which we will park the initial fund and second is Equity scheme in which we will transfer certain amount on a specified date of each month as per instruction generated by the software.

2] By monitoring the Market Risk as well as the Portfolio's Performance,Our software will guide you on a specified date how much is to be transferred to equity fund from debt fund [This process is called BLTPTM]

3] By monitoring the Market Risk as well as the Portfolio's Performance Our software will guide you how much profit is to be booked from equity fund to debt fund. BLTPTM is suitable for any Investor weather he wants to Invest Lump sum or in part or Monthly SIP.

4} BLTPTM is also suitable for any Goal you have to achieve weather you need to accumulate the Goal Amount or need Monthly Income.

Contact Details |

Business Link Consultancy Services |

| A-6 Madhoor Mangal Avenue Phase - 2, |

| B/h Vanvihar Colony, |

| Nashik 422007 |

| Contact No. |

| (+91) 93715 21221, |

| (+91) 70202 10271 |

| Email: |

| business_lnk@yahoo.com |

| Office Hours: |

| Monday - Friday: 9:00 AM to 12:30 PM |

| Face Book |

| Google+ |